Condo Insurance in and around Pine Bluff

Pine Bluff! Look no further for condo insurance

Quality coverage for your condo and belongings inside

- White Hall

- Redfield

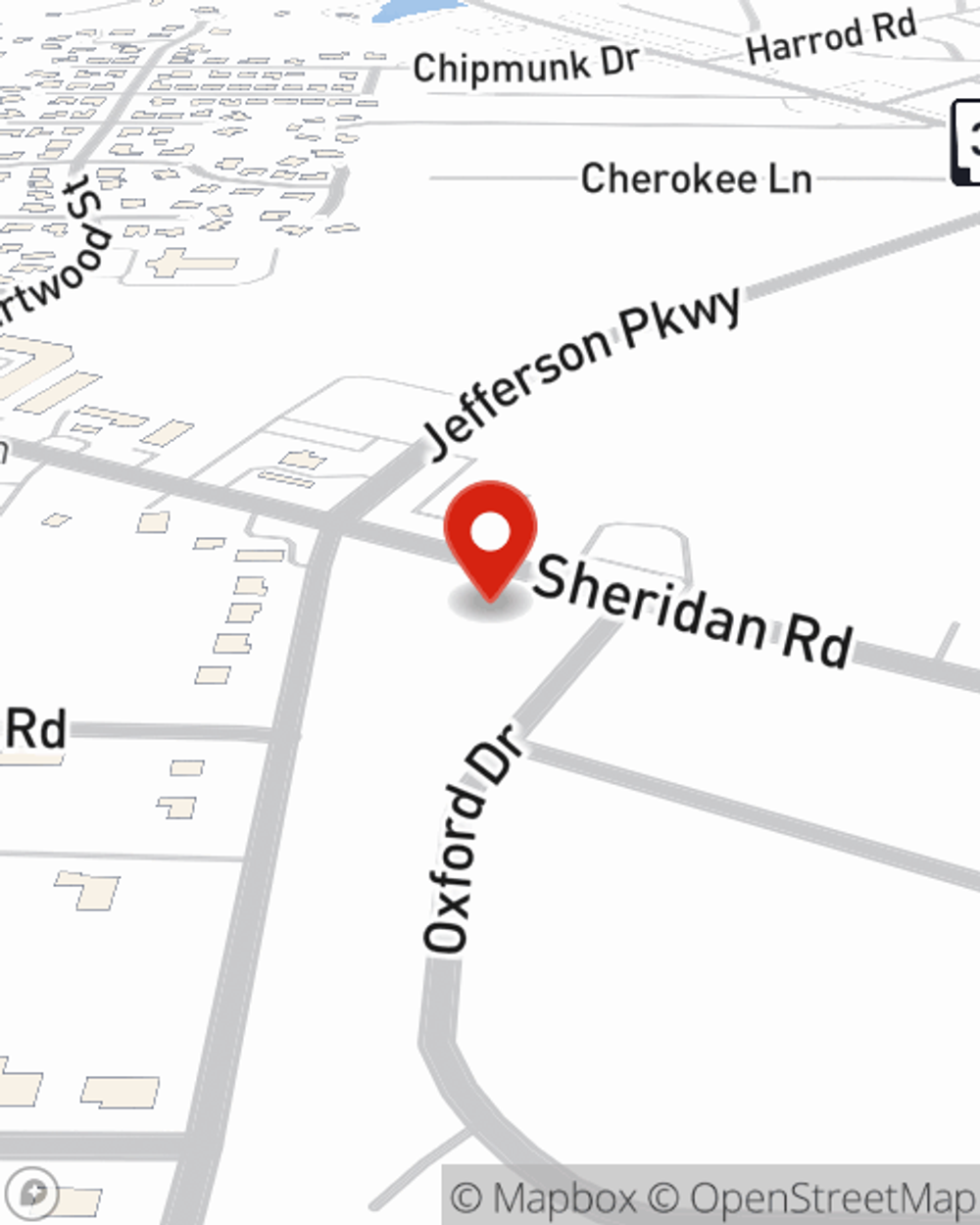

- Sheridan

- Rison

- Woodlawn

- Star City

- East End

Home Is Where Your Condo Is

Because your condo is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to theft or freezing pipes. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Pine Bluff! Look no further for condo insurance

Quality coverage for your condo and belongings inside

Protect Your Condo With Insurance From State Farm

Despite the possibility of the unanticipated, the future looks bright when you have the terrific coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your condominium and personal property inside, you'll also want to check out bundling options for replacement costs, and more! Agent Aaron Loetscher can help you create a policy based on your needs.

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Contact agent Aaron Loetscher today to get started.

Have More Questions About Condo Unitowners Insurance?

Call Aaron at (870) 534-5381 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Aaron Loetscher

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.